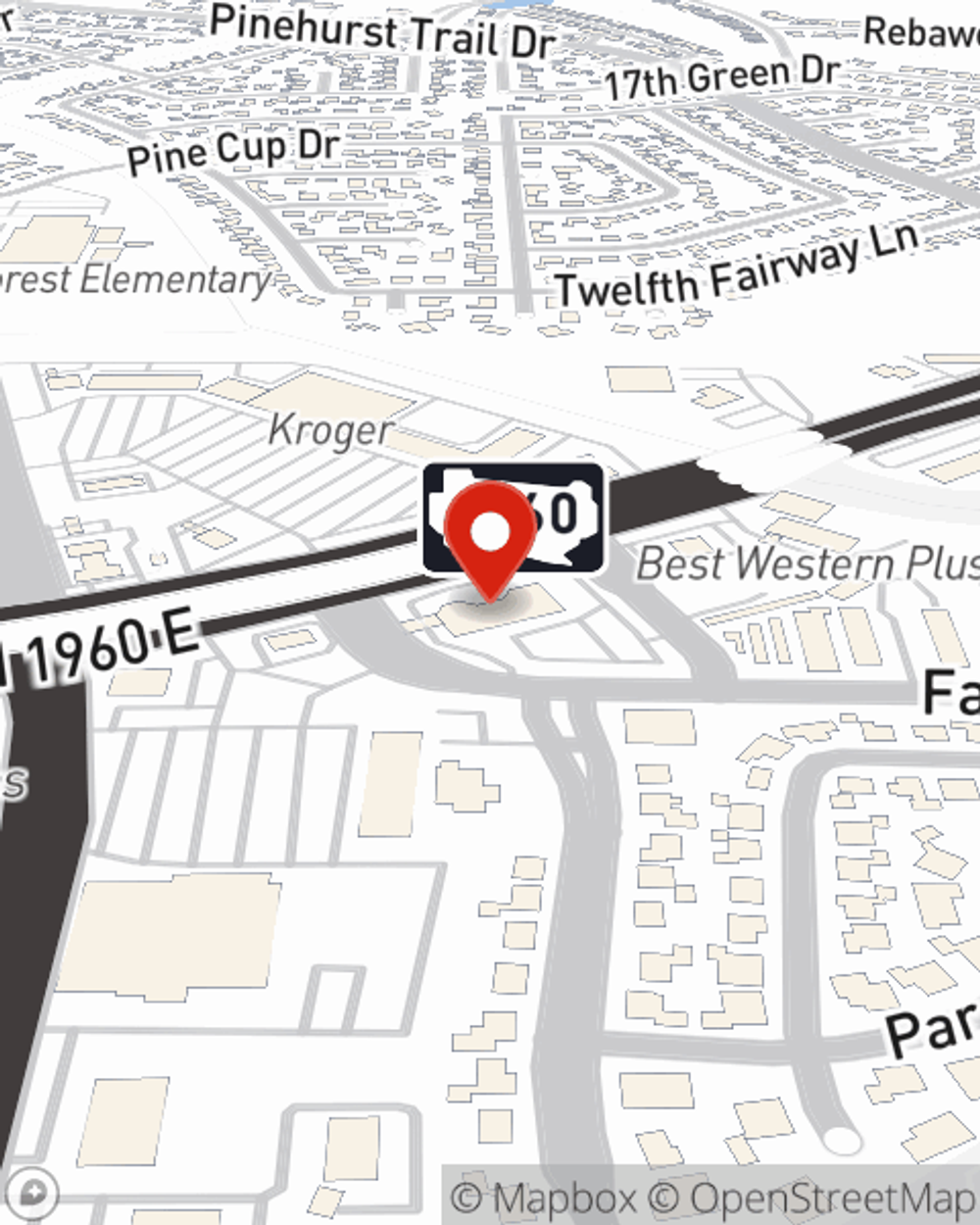

Business Insurance in and around Humble

One of the top small business insurance companies in Humble, and beyond.

Helping insure small businesses since 1935

Your Search For Excellent Small Business Insurance Ends Now.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected loss or damage. And you also want to care for any staff and customers who stumble and fall on your property.

One of the top small business insurance companies in Humble, and beyond.

Helping insure small businesses since 1935

Strictly Business With State Farm

With State Farm small business insurance, you can give yourself more protection! State Farm agent Dale Guidry is ready to help you prepare for potential mishaps with dependable coverage for all your business insurance needs. Such personalized service is what sets State Farm apart from other business insurance providers. And it won’t stop once your policy is signed. If mishaps occur, Dale Guidry can help you file your claim. Keep your business protected and growing strong with State Farm!

Ready to explore the specific options that may be right for you and your small business? Simply contact State Farm agent Dale Guidry today!

Simple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.

Dale Guidry

State Farm® Insurance AgentSimple Insights®

Cover two people with one policy, often at lower cost

Cover two people with one policy, often at lower cost

Joint universal life insurance can cover two people with an income tax-free death benefit paid to beneficiaries.

How to spot a roof leak and what to do if you have one

How to spot a roof leak and what to do if you have one

From mold on the roof to missing shingles, learn how to find roof leaks and know what to do.